Contents:

There was also a great deal of uncertainty about regulation, which Stumm hadn’t factored into the business model or the trading system. To be fair, retail online currency trading was a new frontier in the early 2000s, and it wasn’t clear in Canada or the United States what rules should apply to it, or even which agencies should regulate it. In 2003, Stumm phoned Katten Muchin Zavis Rosenman, a Chicago law firm renowned for its expertise in regulation of futures and options trading, to ask for advice. Now, 12 years later, Oanda Corp.—the company he co-founded with a high school friend from Switzerland, financier Richard Olsen—is one of North America’s largest retail forex trading firms.

Oanda also has offices in Singapore, Tokyo, Toronto, Chicago and Zurich. This software provides a great way for us as a firm to use the same rates. I use OANDA in my work to check the most recent rates for the different currencies. https://broker-review.org/ Their online calculator is really helpful and it’s free. OANDA – Financial company in Toronto, ON – 370 King Street West, Toronto, Ontario. Read verified and trustworthy customer reviews for OANDA or write your own review.

For the approach that I take to trading, the interfaces are good. Order execution is good, but of course you have to understand that bid/ask spreads can “flare” at times, so that you won’t be shocked when it happens to you. If you reach out to our support team, they will be able to investigate why your stop loss is being triggered. From time to time my account is locked for no apparent reason. We are glad to hear about your positive experience with our services. Like many forex brokers meanwhile, Oanda also provides a training and information area, which is summarized under the heading Academy.

Reviews by company size (employees)

In addition, most CFD transactions are of short duration and are in any event marked to market and cash settled daily. Deposit fees – Oanda trading accounts can be opened in 9 different currencies and maintained via 3 different funding methods; cards, bank wires and PayPal . Deposited funds are available, usually, within 10 minutes.

That switch was completed in 2001, and it shrank price increments and profit margins to fractions of a penny per share. When University of Toronto computer engineering professor Michael Stumm decided to launch an online currency trading platform for individual investors in 2001, he had no idea of the regulatory obligations involved. Nor did he have any experience in dealing with the powerful international banks that dominate foreign exchange—forex—the world’s largest, fastest and most liquid market, with a daily global trading volume of about $4 trillion (U.S.). Stumm spent a modest $250,000 to have four of his former students help him write the software. Several major elements were needed for the platform, but they weren’t too difficult for sharp programmers to write cheaply. The system had to accept cash from clients , shoot it into the firm’s bank account, monitor market exchange rates, offer users immediate price quotes , execute trades instantaneously, yet prevent clients from risking too much money.

This risk mitigation system prevents the client from being required to provide additional capital to cover the margin deficiency or losing more than their stated risk capital or cumulative loss limit. This functionality also ensures that the Filer will not incur any credit risk vis-a-vis its customers in respect of CFD transactions. It’s accurate tool that provides great details for the relevant exchange rates.

Such job security and earnings have cushioned many Americans from the worst price pressures since the 1980s and encouraged them to continue spending, further feeding inflation. This was after the Consumer Price Index — a barometer for inflation — expanded at an annual rate of 5% in March versus February’s 6%. In June, the so-called CPI was up 9.1% on the year, hitting a four-decade high.

Min Deposit $50

On the other hand, traders also are given the chance to use MetaTrader 4. You have access to a wealth of data on currency rates from all over the world. This provides a consistent way to track rates firm wide.

Higher rates tend to benefit the dollar and weigh on oil. WTI for June delivery showed a final trade of $82.43 as per capital.com data carried by Investing.com. June WTI officially settled at $82.43, up 39 cents, as per CME data. New York-traded West Texas Intermediate for May delivery settled at $82.52 — up 36 cents, or 0.4%, on the day — as per CME data.

- This means that in extreme market volatility and without an adequate stop loss in place, a losing trading position can cause a negative account balance.

- While the yellow metal is a popular insurance against economic and political troubles, it does not yield anything.

- Even colleagues who still admired Stumm were fed up with being lectured and badgered as if they were lethargic undergrads.

- I want to thank OANDA, especially Bradley, for the help and support they gave me during registration and setup.

- Oanda provided me with among the best platform in the market and did its best to keep me informed about the market, as well as, invited me to some free webinars.

The corresponding app is offered for both Android and iOS operating systems. Additionally , various analysis tools may be used in mobile trading and real-time rates and premium financial news are available. I used the OANDA free trial to learn how to trade the market, so virtual, not real cash was used. The platform was easy to use and I could oanda review easily have moved to an account trading real cash. I’m still practicing though, so OANDA is on the top of my list to open a real account when I am ready. For accounts opened via Oanda USA, Oanda Canada, Oanda Singapore and Oanda Japan there is no Negative Balance Protection, to prevent clients from keeping their accounts balance below zero.

Other great alternatives to OANDA

Oanda launched its platform, called fxTrade, for users anywhere in the world in March, 2001. Over the next four years, its volume grew to 250,000 trades a day, and Oanda’s workforce expanded to 50 employees. Olsen’s Swiss banking family didn’t want to fund a competitor, no matter how small, so he and Stumm gathered up some of their own money.

Indeed, Stumm was worried even if a client put in an order for more than $100,000. So he installed a function that automatically sold off any trade that exceeded that limit to a large bank, sometimes at a small loss, if necessary. When the client reversed the order, Oanda reversed its order with the bank. Stumm also wanted to ensure that the firm’s total exposure to euros, U.S. dollars or any other single currency didn’t get too large during the day. The solution to that was to automatically batch together client positions in that currency and flatten them out—sell them to a bank at the market rate at that moment.

About OANDA

Grocery prices saw another decline in the month of April, down 0.2% month-over-month. Year-over-year though, prices are still up, 7.1%. Despite the weak demand situation for gas, price action on the Henry Hub indicates clear momentum accumulation from the horizontal support base formed at $1.94 and was attempting to break above the 5-week EMA of $2.21, said Dixit.

Energy Information Administration, or EIA, reported that gas-in-storage in the United States rose by 25 billion cubic feet, or bcf, last week in the first series of injections for the spring season. Natural gas futures overcame the odds on Friday to rally to a positive weekly close, after five weeks in the red. Notwithstanding gold’s latest setback, Moya said there were enough reasons for investors to stay positive on the safe haven. While policy-makers the world over typically celebrate on seeing good jobs numbers, the Fed faces a different predicament. The central bank wishes to see an easing of labor conditions that are a little “too good” now for the economy’s own good — in this case, unemployment at more than 50-year lows and average monthly wages that have grown without stop since March 2021. One of the Fed’s biggest challenges has been stellar jobs data as the nation’s labor market continues to stun economists with stupendous growth month after month.

Min Deposit $100

Use our tool to get a personalized report on your market worth. The Oanda platform is friendly to the user with a verity of tools, news and information. I especially like the ability to program the MQ5 programs and find useful trading programs to upload to the charts.

This allows Oanda to stand out from some other brokers, where the demo account can be used for a maximum of 14 or, in the best case, 30 days. It’s positive that Oanda provides its customers with live support as well as email contact. Additionally, a telphone number can be used to reach out to Oanda from Sunday 1 p.m. This also applies to live chat, which might be a good way to get questions answered relatively quickly. One advantage is certainly that additionally to manual trading, fully automated trading is also possible.

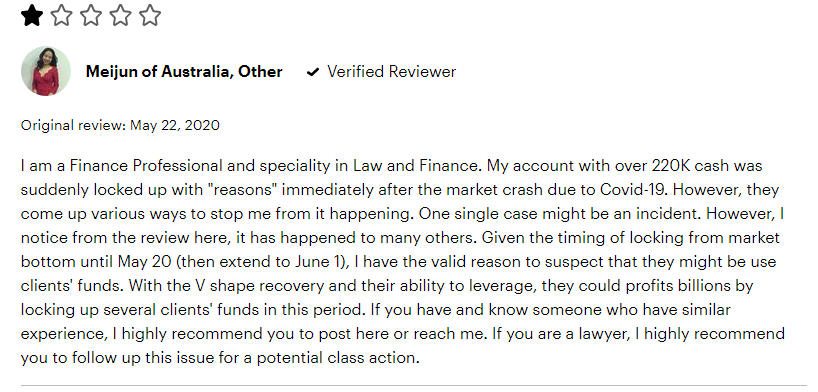

With no forewarning, they attempted to charge a fee for leaving my inactive account open. When I asked them why I received no prior notification that such a charge would be made, they replied by saying they did not notify me because they were not legally required to do so. When attempting to open my new account, I tried to verify 6 times but failed … Their account verification system simply did not work … I was able to eventually fund an account, but only after many more attempts and much angst.

I would strongly advise anyone looking for a reliable and efficient broker to steer clear of this one. Their lack of attention to detail and poor customer service make it clear that they are not worth your time or money. Wish more markets available to US customers…as well as charts for crypto.

Many of the online forex trading upstarts that launched around the same time it did have gone out of business. Unlike certain OTC derivatives, such as forward contracts, CFDs do not require or oblige either the principal counterparty nor any agent to deliver the underlying instrument. Withdrawals fees – For withdrawals, there are no fees for the first withdrawal processed within the calendar month, if the withdrawal method is by card, then a fee of $15/€20 applies. If traders withdraw with bank wire, then a fee of $/€ 20 applies for the first monthly withdrawal and a fee of $/€ 35 for subsequent withdrawals.

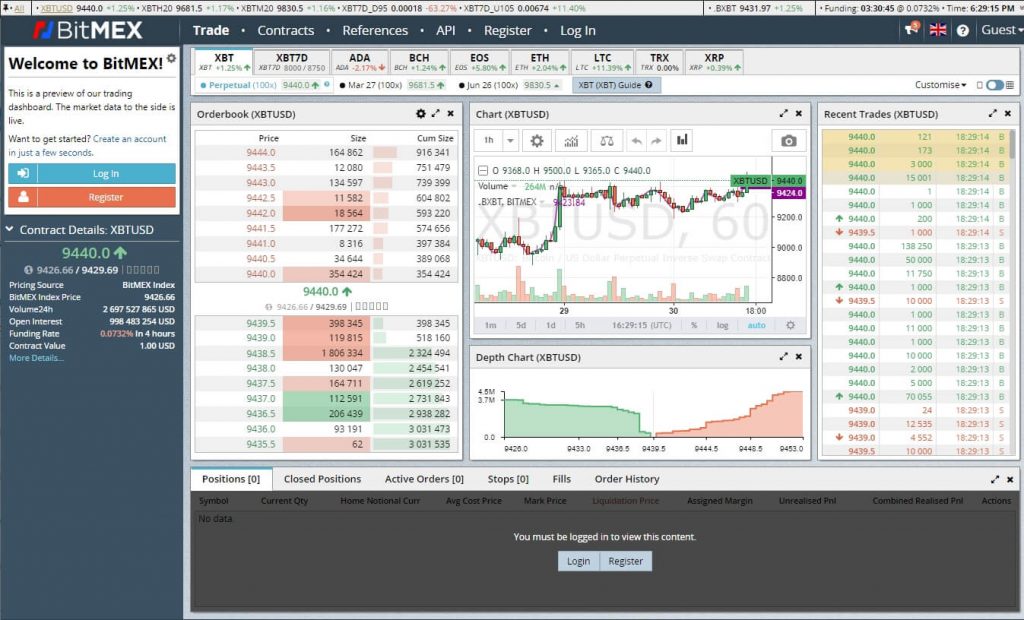

For the most popular pair the EUR/USD, 1 traded lot is 5 USD (2.5 USD per side). This commission is slightly lower compared with all the other top FX brokers. Trading can be done via the classic Metatrader 4 and Oanda’s own proprietary platform, Oanda Trade, available on web, desktop and mobile versions. Oanda offers a limited selection of around 115 assets to trade, including Forex, indices, bonds and commodities. Currently, Oanda trading accounts are available in AUD, CAD, CHF, EUR, GBP, JPY, SGD, USD and HKD. Oanda does not offer any MAM/PAMM accounts alternatives for money managers.